Besides installing surveillance cameras and hiring well-trained guards, it’s paramount to secure your home by taking a homeowner’s insurance cover. Natural disasters and accidents could leave your home a wreck, adding a lasting dent to your finances. A premium home insurance cover shields you financially in the event of accidents and damages. Not sure which Pennsylvania home insurance company to choose from, we’ll recommend the top four insurers with the best endorsements, prices, coverage options, and discounts.

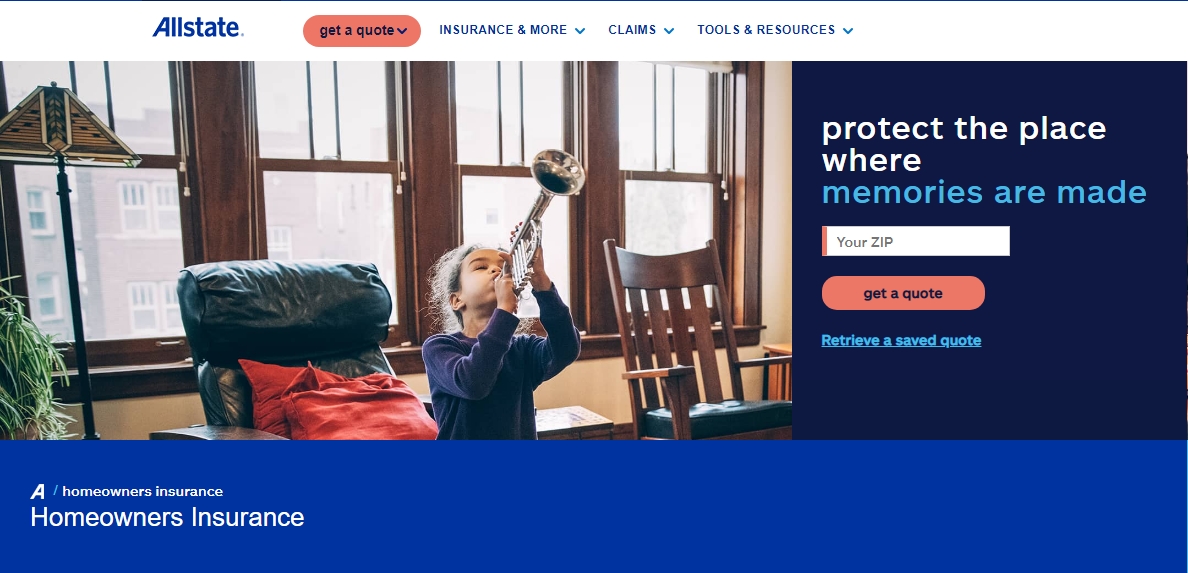

1. Allstate Homeowners Insurance

Those living in Pennsylvania districts that experience horrible ice and snowstorms, frequent fires, and extreme winds can never go wrong with an Allstate homeowner insurance policy. Regardless of your home size, coverage type, and location, Allstate has got a personalized insurance policy for you. Select from three core policies, including personal umbrella, flood, and earthquake policies. Keep your insurance premiums low with the company’s discounts, including claims-free, safe home features, easy pay plan, welcome and loyalty bonuses, 55 and retired, and early signing. The company’s customer service is excellent, as well. The average coverage cost of a premium home insurance policy by Allstate stands at $1452 annually.

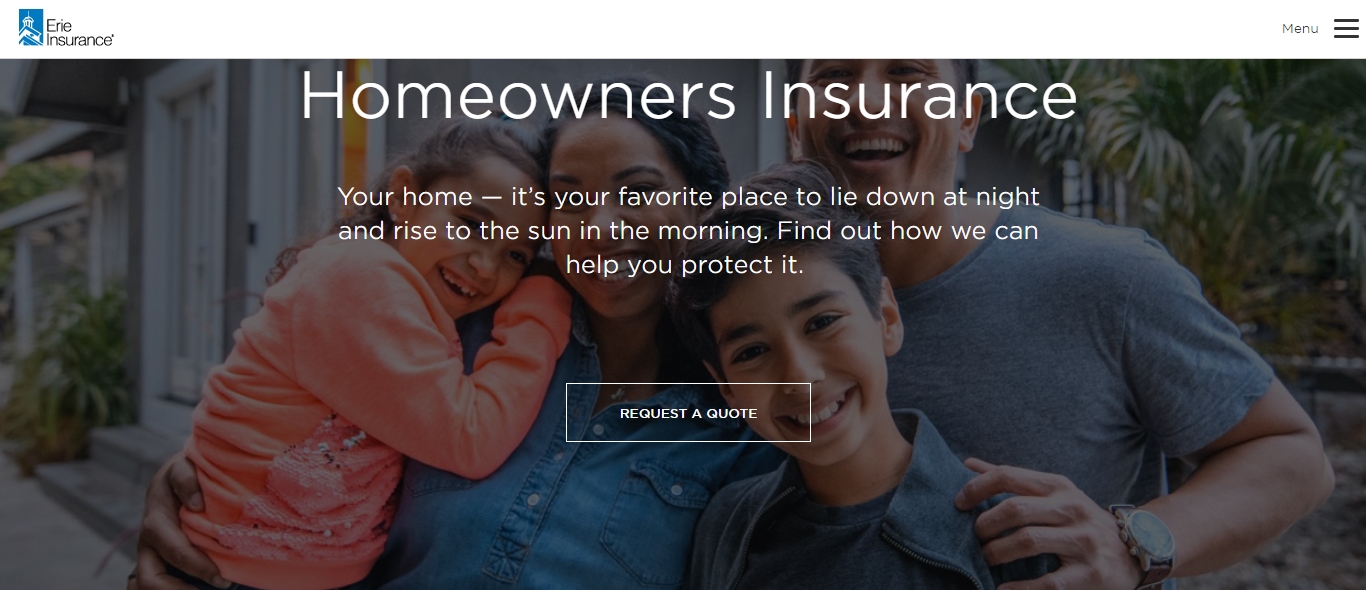

2. Irie Homeowners Insurance

Priced at an average of $855 annually, an insurance cover with Irie homeowners insurance protects your finances and mental health in the event of a natural disaster or burglary. By far the cheapest homeowner policy in Pennsylvania, Irie homeowner insurance coverage pays for losses caused by theft, fires, earthquake, floods, and other natural disasters. Regardless of your claims history, age, credit score, and home location, Irie will always have a perfect package for you. You can take advantage of the several discount packages offered by Irie, including advanced quote discounts, multi-policy discounts, and security discounts. The company also boasts an incredibly excellent 24-hour customer care service.

3. Lemonade Homeowners Insurance

Give your property 24-hour protection against natural and artificial disasters when you buy a homeowner insurance policy with Lemonade homeowner insurance. With its low rates, transparent model, and user-friendly mobile app, Lemonade makes insuring Pennsylvania homes a breeze. Unlike other insurers, lemonade use 20% of customer premium to pay for operating costs and gives the remaining amount to charity. The company’s homeowner insurance packages cover reconstruction costs, medical bills for people injured in your property, and loss of use. You’ll also get endorsements for your valuables, including jewelry and art.

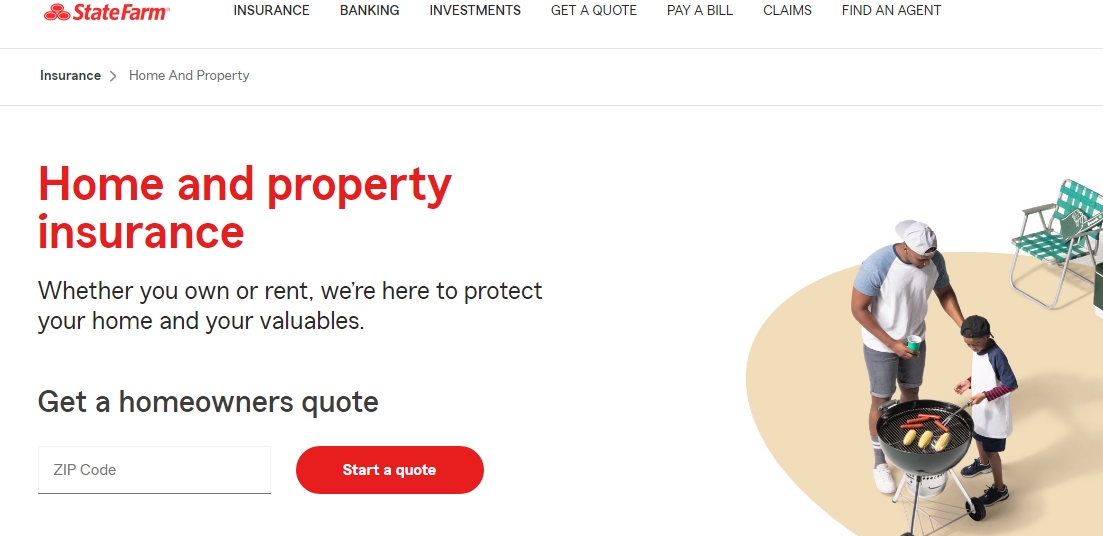

4. StateFarm Homeowners Insurance

Buy a homeowner’s insurance policy from StateFarm and save on repair costs when your home gets damaged by underground water, floods, nuclear hazard, earthquakes, mudslides, and more. The company offers personalized insurance services for homeowners in different parts of Pennsylvania. While the packages are slightly higher, the company commits to giving excellent customer service and prompt payment of claims. Sadly, the company’s homeowner insurance policy doesn’t cover damage triggered by mold.

| Insurance Company | Average Annual Cost | What Is Not Covered | What is Covered | What is not known for | Do they offer discounts |

| Allstate | $1,452 | Jewelry and watches | Damage from fire, theft, vandalism, smoke, hail, lightning, and wind | Best coverage and excellent customer service | Yes |

| Irie | $855 | Earthquake and floods damage | Loss of use, liability protection, damage from storms, fire, and theft | Affordability, reliability, and good customer service | Yes |

| Lemonade | $1083 | Earthquake, floods, lost valuables, and internal property damage | Damage from earthquake, vandalism, theft, fire, tornado, and wind | Transparency, excellent customer service, and timely response | Yes |

| StateFarm | $1,500 | Floods and earthquake damages | Damage from theft, fire, lightning, windstorm, hail, and plumbing system freezing | Superior coverage, quality | Yes |

Considerations When Buying Pennsylvania Homeowners Insurance

When requesting insurance quotes and comparing policies from the four Pennsylvania homeowners insurance providers, consider these three factors:

- Deductible – homeowner insurance payable rate depends on the deductible. A higher deductible translates to a lower rate.

- Roof—the cost of an insurance premium links to your home’s roof condition directly. Older and tired roofs will always raise the payable rate and premiums. In some instances, Pennsylvania homeowner’s insurance providers won’t award you coverage before replacing your home roofing system.

- Crime statistics – living in areas prone to criminal activities can also raise your insurance premiums.